Your Guide to the Most Impactful 2018 Legislative Amendments to the Florida Statutes

Reading Time: 6 minutes

Each year the Florida Legislature proposes and votes on bills for amending the Florida Statutes. Bills that pass both the Florida House and Senate go before the Governor who decides which bills become law. In the 2018 legislative session, approximately 150 fewer bills were proposed, and 40 fewer bills ultimately passed, than in 2017. Nevertheless, Governor Scott signed into law several important amendments to the Florida Statutes. This article provides a cursory overview on each 2018 legislative amendment to the Florida Statutes that could impact you.

Legislative Amendment: Corporate Income Tax (House Bill 7093; Fla. Stat. § 220.13)

This law updates the Florida corporate income tax code by partially adopting the Federal Internal Revenue Code (IRC) of 2018. However, there is a distinction from the IRC. Federal law allows qualified property to be fully and instantaneously depreciated. Conversely, Florida only allows the depreciation of qualified property based on a 7 year table. Finally, the corporate income tax rate remains at 5.5 percent.

Legislative Amendment: Commercial Lease Sales Tax (House Bill 7087; Fla. Stat. § 212.031(1)(c) & (d))

A slight tax benefit is available to those who lease commercial property. Rather than the 6 percent state level tax, sales tax for commercial rental payments is reduced to 5.7 percent. Furthermore, this tax is levied on the total rent or license fee charged for the property, which shall include base rent, percentage rents or similar charges.

Legislative Amendment: Tax Credits for Commercial Leases (House Bill 7055; Fla. Stat. § 212.099)

This law is titled the “Florida Sales Tax Credit Scholarship Program for Commercial Leases,” and authorizes any tenant who pays a rental or license fee that is subject to the business rent tax to make a contribution to a nonprofit scholarship-funding organization. If the tenant decides to do so, he or she will receive a credit in the same amount to offset the tenant’s sales tax liability.

Legislative Amendment: Worker’s Compensation (Senate Bill 376; Fla. Stat. § 112.1815)

Previously, first responders could not receive full worker’s compensation benefits for mental or nervous injuries unless they were accompanied with a physical injury. If the mental or nervous injury was unaccompanied by a physical injury, only medical benefits under Section 440.13, Florida Statutes, would be payable for the injury. However, if the mental or nervous injury was accompanied by a physical injury, then the first responder could also receive compensation for disability under Section 440.15, Florida Statutes. Effective October 1, 2018, the Florida Legislature created an exception to the physical injury requirement by defining Post-Traumatic Stress Disorder as a compensable “occupational disease” for first responders. Consequently, with PTSD being a compensable occupational disease, first responders suffering from PTSD may now receive payment of medical expenses along with paid disability. And for reference, first responders include firefighters, EMTs and law enforcement.

Legislative Amendment: Primary Care Agreements (House Bill 37; Fla. Stat. § 624.27)

The Florida Legislature clarified that primary care agreements are not insurance and, therefore, not regulated by the Florida Insurance Code. A primary care agreement is a contract between a primary care provider and an individual patient in which the health care provider agrees to offer care services to the individual patient for an agreed-upon fee and period of time. This new law does not specify how much is charged or what services are provided in a primary care agreement. Rather, it merely amends Florida’s Insurance Code, making it clear that direct primary care agreements do not violate Florida’s insurance regulations.

Legislative Amendment: Pharmacy Disclosure Requirements (House Bill 351; Fla. Stat. § 465.0244)

Pharmacies must now include a hyperlink on their websites advising on:

- the costs of prescriptions; and

- whether a patient’s cost sharing obligation exceeds the retail price of a drug in the absence of prescription drug coverage.

Also, pharmacies must post the notice at their businesses in the area where customers receive prescriptions. Lastly, it must state that this information is available on their websites.

Legislative Amendment: Flood Insurance (House Bill 1011; Fla. Stat. § 627.7011)

Homeowners’ insurance policies must now disclose in bold 18-point font that hurricane insurance does not include flood insurance, even if hurricane winds and rain caused the flood to occur. Furthermore, the disclosure must also clarify that without separate flood insurance coverage, the person being insured might have uncovered losses due to a flood.

Legislative Amendment: Assisted Living Facilities (Senate Bill 7028; Ch. 2018-122, Florida Statutes)

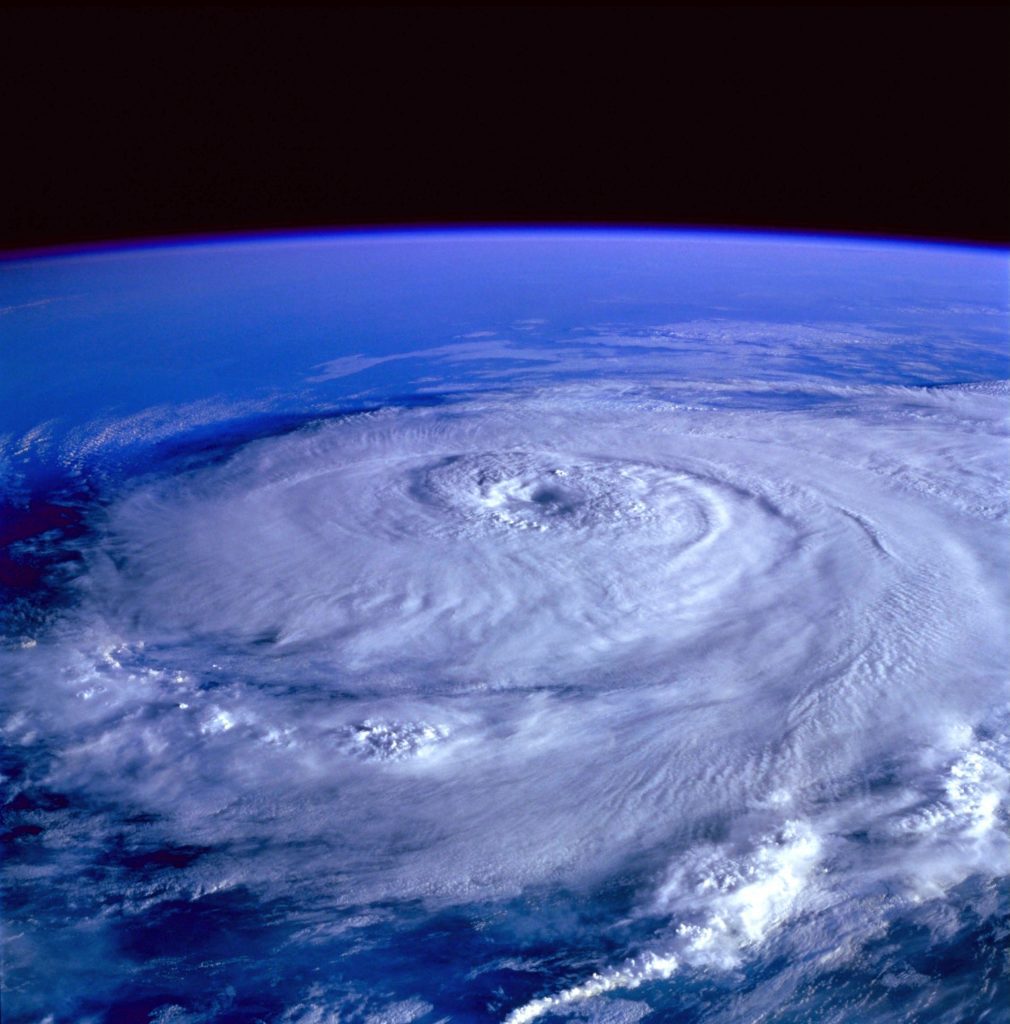

Inspired by the loss of life at an assisted living facility in the aftermath of Hurricane Irma, this law now requires assisted living facilities to have backup power sources available. Now, these facilities must have alternate power supplies capable of maintaining the inside temperature at 81 degrees or less for at least four days. As a result, the expected aggregate cost for Florida’s 3,000 assisted living facilities to comply with this law is approximately $243 million. To help offset these costs, the Florida Legislature created a small tax break for facilities that purchase electric generators.

Legislative Amendment: Sales Tax Holidays (House Bill 7087; Fla. Stat. § 20.21)

This legislation reinstates one tax holiday and creates another. The legislature annually passes the Back to School Sales Tax Holiday. This year, the tax holiday provides for a three-day sales tax reprieve from August 3rd to August 5th. Certain items that cost $60 or less, such as clothing, footwear and bags are exempt from state sales tax and county discretionary sales surtaxes. Certain school supplies that cost $15 or less per item are also exempt. Unlike last year, personal computers that cost less than $750 are no longer exempt.

The second is the Disaster Preparedness Sales Tax Holiday. This provides a seven-day sales tax reprieve from June 1st – 7th for specific items related to disaster preparedness. Such items include:

- reusable ice packs;

- portable self-powered light sources, such as candles and flashlights if under $20;

- any gas or diesel fuel container, that sells for $25 or less;

- batteries that sell for $30 or less;

- radios that sell for $50 or less; and

- generators that sell for $750 or less.

Legislative Amendment: Tax Abatement for Hurricane Damage (House Bill 7087; Fla. Stat. § 197.318)

Provides for an abatement of taxes for residential improvements damaged or destroyed by Hurricanes Hermine, Matthew or Irma. Property owners can receive a tax abatement if their residential improvement was rendered uninhabitable for at least 30 days and caused by one of these hurricanes. However, the property owner must file an application with the local property appraiser by no later than March 1, 2019. That appraiser will then make a recommendation to the tax collector and they will calculate the damage differential. Furthermore, the tax collector will determine the ultimate disaster relief credit pursuant to the parameters of this new law. Finally, if awarded, a refund amount will be given to the property owner equal to the disaster relief credit.